In true trying-to-do-too-much-at-once fashion--aka my daily struggle--I had to blow off a few to-dos in late April and early May. One of those things was my Budgeting Bloggers post, which is a (relative) shame because I had a crazy haul in April! In comparison, I didn't technically buy clothes in May...but I did use some honeymoon spending money to pick up a couple cute souvenir-type pieces while we were in Mexico. So, better late than never, here's my April budget breakdown:

1. Adorbs t-shirt from Target. I was shopping with my sister and grandma, hungover, the day after my bachelorette party. I practically sprinted to this shirt, the last one in the store, and realized it was miraculously in my size. I've been wearing it almost nonstop ever since. (Including on my wedding morning, natch.) | $12.99 {exact}

2. Lace-trimmed t-shirt from H&M. Another totally frivolous, unnecessary impulse purchase that I don't regret in the slightest. | $9.95 {exact}

3. "Cold Shoulder" top from Express. My first non-warehouse/thrifted Express purchase. Hayley and I were shopping for a dress for her to wear to my bachelorette, and I decided I NEEDED DIS for my pre-bachelorette shindig in Athens. | $34.90 {exact}

4. Ankle-strop flats from Forever 21. Another "this is perfect for Athens" shopping spree spoil. Though walkable, Athens has a ton of brick streets and heels are a definite no. While these were a pain to break in (literally, the buckles cut my ankles wide open), they're super comfy to wear now. | $15.90 {similar}

5. Sidekicks roll-up flats from Party City. Yes, I bought shoes from Party City. But with the heels I was wearing for actual bachelorette party in Columbus (see #6), I knew pack-a-flats were a must. I regret nothing. | $15 {exact}

6. BCBGeneration Cynthia pumps via Macy's. These were exactly what I was looking for. The mesh itself is much finer IRL; it's less of a fishnet and more of a sheer black material. They were on super sale, plus I had a gift card, so my total out-of-pocket was a whopping... | $5.67 {exact, for $30.99)}

7. Tote from Target. Purchased last-minute when I realized I didn't have a beach bag to take on the honeymoon. Doubled as my "bag of emergency crap" that I made my sister lug around the day of the wedding. | $14.99 {exact}

8. Bachelorette party dress from H&M. Because no bachelorette is complete without a lacy, short, see-through-on-top, totally skimpy dress. I've never worn a dress like this and honestly? I felt like a million bucks in it. I have nowhere else to wear it but I love how it looked on me so much, I'm just gonna keep it. Maybe I can dye it black? | $29.95 {exact}

9. Calvin Klein dress from Nordstrom Rack. So I originally had planned to rewear the white Calvin Klein dress I bought secondhand for $10 (worn first at my family bridal shower) to my rehearsal dinner. Then I saw this beauty and fell in love. The hurriedly-taken photo doesn't do it justice; this is another dress I can't quite get rid of because I felt freaking fantastic in it. | $48.16 (with tax)

10. Gold necklace from Old Navy. This was a bad month for impulse buys. I blame my "spend all the money" from last-minute wedding purchases and vendor checks. This grabbed my eye as I was buying flip flops for all my bridesmaids, as you do, and I just snagged it. To be fair, I've been looking for a good, inexpensive, chunky gold necklace for like two years now. Justified? | $12

And that's April! Grand total, including tax: $201.97. Okay so technically I did spend my May budget...just a month early. Oops. The three items I bought in May were all purchased when Matt and I realized we converted way too much wedding-present cash to pesos for our trip. We figured eh, we'd written it off already, and we didn't want to pay the fees to convert it, so we did a fair amount of shopping. We bought a ridiculous amount of Mexican tchotchkies, like the obligatory shot glasses, hot sauce and the like. Matt got a dude-necklace, and I got...

1. Adorbs t-shirt from Target. I was shopping with my sister and grandma, hungover, the day after my bachelorette party. I practically sprinted to this shirt, the last one in the store, and realized it was miraculously in my size. I've been wearing it almost nonstop ever since. (Including on my wedding morning, natch.) | $12.99 {exact}

2. Lace-trimmed t-shirt from H&M. Another totally frivolous, unnecessary impulse purchase that I don't regret in the slightest. | $9.95 {exact}

3. "Cold Shoulder" top from Express. My first non-warehouse/thrifted Express purchase. Hayley and I were shopping for a dress for her to wear to my bachelorette, and I decided I NEEDED DIS for my pre-bachelorette shindig in Athens. | $34.90 {exact}

4. Ankle-strop flats from Forever 21. Another "this is perfect for Athens" shopping spree spoil. Though walkable, Athens has a ton of brick streets and heels are a definite no. While these were a pain to break in (literally, the buckles cut my ankles wide open), they're super comfy to wear now. | $15.90 {similar}

5. Sidekicks roll-up flats from Party City. Yes, I bought shoes from Party City. But with the heels I was wearing for actual bachelorette party in Columbus (see #6), I knew pack-a-flats were a must. I regret nothing. | $15 {exact}

6. BCBGeneration Cynthia pumps via Macy's. These were exactly what I was looking for. The mesh itself is much finer IRL; it's less of a fishnet and more of a sheer black material. They were on super sale, plus I had a gift card, so my total out-of-pocket was a whopping... | $5.67 {exact, for $30.99)}

7. Tote from Target. Purchased last-minute when I realized I didn't have a beach bag to take on the honeymoon. Doubled as my "bag of emergency crap" that I made my sister lug around the day of the wedding. | $14.99 {exact}

8. Bachelorette party dress from H&M. Because no bachelorette is complete without a lacy, short, see-through-on-top, totally skimpy dress. I've never worn a dress like this and honestly? I felt like a million bucks in it. I have nowhere else to wear it but I love how it looked on me so much, I'm just gonna keep it. Maybe I can dye it black? | $29.95 {exact}

9. Calvin Klein dress from Nordstrom Rack. So I originally had planned to rewear the white Calvin Klein dress I bought secondhand for $10 (worn first at my family bridal shower) to my rehearsal dinner. Then I saw this beauty and fell in love. The hurriedly-taken photo doesn't do it justice; this is another dress I can't quite get rid of because I felt freaking fantastic in it. | $48.16 (with tax)

10. Gold necklace from Old Navy. This was a bad month for impulse buys. I blame my "spend all the money" from last-minute wedding purchases and vendor checks. This grabbed my eye as I was buying flip flops for all my bridesmaids, as you do, and I just snagged it. To be fair, I've been looking for a good, inexpensive, chunky gold necklace for like two years now. Justified? | $12

And that's April! Grand total, including tax: $201.97. Okay so technically I did spend my May budget...just a month early. Oops. The three items I bought in May were all purchased when Matt and I realized we converted way too much wedding-present cash to pesos for our trip. We figured eh, we'd written it off already, and we didn't want to pay the fees to convert it, so we did a fair amount of shopping. We bought a ridiculous amount of Mexican tchotchkies, like the obligatory shot glasses, hot sauce and the like. Matt got a dude-necklace, and I got...

1. THIS GORGEOUS DRESS. I saw it hanging in one of the vendor market stalls outside Tulum before we went in to the ruins themselves, and it sat in the back of my mind for the next hour as we walked around. Naturally, I had to have it by the time we left. I scored the dress, but not without some gentle haggling on the price, of course.

2. Mother-of-pearl and abalone necklace. Kind of cheesy, sure, but I love both of those types of shell and think they make lovely jewelry. This guy had a stall right out on the beach and had tons of shell, shark-tooth and other sea-themed jewelry. I got a few compliments on it already, so I figure it was worth it.

3. Pearl necklace. This was one of those "buy an oyster and crack it open and there's a pearl inside" deals (which came with the necklace itself), which I've always thought was really cool. The resort's gift shop had a ton of these. The packaging said the pearls ranged in color, but I lucked out with a pure white one.

4. Sun hat. Another gift shop purchase, on our second-to-last day when we started to realize how many leftover pesos we had. Ridiculously overpriced for a straw hat, but we were on our way to Tulum and I wanted some extra sun protection for my face. Gotta keep this face youthful and wrinkle-free!

Can we just take another look at that red dress again? I can't even. I have no idea where else I might wear it, what with the whole can't-wear-a-bra-and-v-neck-plunging-down-to-my-sternum, but it makes me feel sexy as hell and I love it to pieces. (Though I wasn't wearing makeup in these pictures so I just cropped my face out, haha.)

1. THIS GORGEOUS DRESS. I saw it hanging in one of the vendor market stalls outside Tulum before we went in to the ruins themselves, and it sat in the back of my mind for the next hour as we walked around. Naturally, I had to have it by the time we left. I scored the dress, but not without some gentle haggling on the price, of course.

2. Mother-of-pearl and abalone necklace. Kind of cheesy, sure, but I love both of those types of shell and think they make lovely jewelry. This guy had a stall right out on the beach and had tons of shell, shark-tooth and other sea-themed jewelry. I got a few compliments on it already, so I figure it was worth it.

3. Pearl necklace. This was one of those "buy an oyster and crack it open and there's a pearl inside" deals (which came with the necklace itself), which I've always thought was really cool. The resort's gift shop had a ton of these. The packaging said the pearls ranged in color, but I lucked out with a pure white one.

4. Sun hat. Another gift shop purchase, on our second-to-last day when we started to realize how many leftover pesos we had. Ridiculously overpriced for a straw hat, but we were on our way to Tulum and I wanted some extra sun protection for my face. Gotta keep this face youthful and wrinkle-free!

Can we just take another look at that red dress again? I can't even. I have no idea where else I might wear it, what with the whole can't-wear-a-bra-and-v-neck-plunging-down-to-my-sternum, but it makes me feel sexy as hell and I love it to pieces. (Though I wasn't wearing makeup in these pictures so I just cropped my face out, haha.)

And there you have it, folks. Check yet another item off my to-do list...even if it is a month late.

And there you have it, folks. Check yet another item off my to-do list...even if it is a month late.

So I had originally intended to get this post up yesterday and an outfit post up on Friday, but my internet at home had other plans. As in, plans to crap out entirely. I called my service provider, who tried to troubleshoot it for a few minutes, but couldn't connect to my modem. She then gave me a few more instructions and told me if they didn't work, I'd have to troubleshoot my wireless router. It sounded fishy, like she was just trying to get rid of me (end of her shift, maybe?) and sure enough, her instructions didn't work. After troubleshooting my router for an hour, I called my service provider back and spoke to a very helpful guy who gave us a $20 credit on our bill and scheduled a tech to come out and look at the modem, which was probably faulty. So, there's that.

The tech comes out tomorrow; I write this now from a booth at Panera. Oh, the "sacrifices" we make for blogging ;)

Anyway, I had a pretty good month, budget-wise. I filled a few gaping holes in my closet and even snagged an item I've been coveting for months at a crazy-deep discount. So, without further ado:

1. and 2. Women's Perfect Crew-Neck Tees from Old Navy. I needed to replace my white one, and I snagged the blue (which is a much darker navy IRL) to get the $6 each deal. | $12 {exact}

1. and 2. Women's Perfect Crew-Neck Tees from Old Navy. I needed to replace my white one, and I snagged the blue (which is a much darker navy IRL) to get the $6 each deal. | $12 {exact}

3. Sequin Detail Striped Cotton Tee from LOFT. I've wanted this for AGES but couldn't justify dropping $40 on it. So whenI saw that Whitney was selling hers, I snapped it right up. | $12 {exact}

4. Denizen jeans from Target. Supposedly I bought the "Celestial" jeans, but these "Afterglow" ones look more like what I actually bought. Either way, I've been needing some dark wash bootcut jeans for way too long. | $29.63 {exact}

5. Mossimo Vikki Pointed Toe Studded Flat from Target. If these look familiar, it's because this is the third time I've bought them. I just wear them so often, they wear right out. Worth the re-buy, every time. | $20.43 {exact}

6. Pleated skirt from LOFT. Another item from the Whitney purchase, and another "why haven't I bought this yet?" item. | $10 {similar}

7. Rock & Candy Huntington flats from Famous Footwear. In a desperate search for cute, casual shoes, I stumbled into Famous Footwear for the first time. How have I never shopped here before?? My next month's budget might consist of only shoes. And that would be fine by me. | $21.49 {exact}

Total spent: $105.55. Not too shabby at all, I say!

Do you have a monthly clothes budget? How did you do?

So I think I mentioned previously that some overspending on various things in March led me to put myself on a shopping hiatus for April. I actually did pretty well, though I did snag this skirt from Forever 21 using a store credit I had from a return. Total cost out of pocket? A whopping 80 cents. (The skirt itself is $10.80 full-price, so you can and should totally snag one yourself!)

I suppose technically I did also buy some items from Whitney's closet cleaning-out sale, but I bought them yesterday and haven't received them yet, so I'm just gonna count them as part of my May budget ;)

Once again, I'm joinig Franziska's Budgeting Bloggers link-up. Head over there and check out all the other bloggers' sweet scores!

I suppose technically I did also buy some items from Whitney's closet cleaning-out sale, but I bought them yesterday and haven't received them yet, so I'm just gonna count them as part of my May budget ;)

Once again, I'm joinig Franziska's Budgeting Bloggers link-up. Head over there and check out all the other bloggers' sweet scores!

Ok so right up front, I'm going to say that most of what I bought this month won't be appearing on the blog. Because the majority of my budget was spent on socks and underwear. And socks are too boring to show, and there's no way in heck I'm showing you guys my underwear :P I also bought a swim cap that I may or may not end up keeping; I'm taking swim lessons at my gym and hope to replace the treadmill/elliptical/stationary bike with swimming laps!

Anyway, the one thing I got that I will show you is a sweet pair of Prana pants, in anticipation of climbing/hiking season! I'm a few months away, but I just can't wait for the weather to be warm enough to break them in!

I got them on sale at The Clymb, which means they're probably discontinued from Prana itself. They zip away at the knee, which is perfect for hiking. Keep 'em long in the woods, then zip 'em off once you get to the crag. They were $34.98. (If you like these, you can still find them on Amazon for significantly more than I paid.)

The rest of my budget breaks down thusly:

I got them on sale at The Clymb, which means they're probably discontinued from Prana itself. They zip away at the knee, which is perfect for hiking. Keep 'em long in the woods, then zip 'em off once you get to the crag. They were $34.98. (If you like these, you can still find them on Amazon for significantly more than I paid.)

The rest of my budget breaks down thusly:

- $16.31 on long- and short-cuff socks at Target

- $39.75 on underwear at Victoria's Secret. It was the semi-annual sale, and I might have gotten a little purchase-happy...ha

- $8.22 on a swim cap from Amazon

Total $99.26. A whole 74 cents under budget, woohoo! How'd you do on your clothes budget? And hey, don't forget to share with Franziska's Budgeting Bloggers link-up!

So I totally failed last Friday, which is when I meant to post this. Oops. Anyway, I was really good last month; I even came in way under my $100 budget! Yay me. Here's what I got:

1. Olive skinny jeans from H&M. They were on sale, and I got another 10% off for signing up for H&M's mailing list (which I somehow don't get emails from. Yay!) $8.95 |exact|

1. Olive skinny jeans from H&M. They were on sale, and I got another 10% off for signing up for H&M's mailing list (which I somehow don't get emails from. Yay!) $8.95 |exact|

2. Chunky sweater from H&M. I've been searching for some good sweaters for a while. This was only left in a large, so I swim in it, but I kinda like it that way. $24.95 |exact (I think?)|

3. Thin sweater from H&M. I couldn't find an exact photo online, but here's me wearing the real deal. There was a hole in it, so I got 10% off. The hole has since grown because I'm wearing this so much (see previous link), so I have a little repairing to do. Worth it. $13.45 |similar|

4. New sunnies from Target. I lost mine. Cat-eye FTW! $12.99 |exact|

(not pictured)

5. Pantyhose from Walmart. It was an emergency last-minute purchase that had me and my friend Hayley rushing through Walmart in full-on eveningwear. We (she) also bought Spanx, lip gloss and like eight cases of beer. It was interesting, to say the least. $4.74

6. Nose rings from Hot Topic. Mine fell out while Matt and I were camping back in late October. I was using one I had on hand and hated, so I snagged up a couple packs of extras during a BOGO half-off sale. $20.96.

Total with tax: $89.59. Boo-yah achieved.

Ok, since both of these are pretty short and sweet, I'm combining them into one post. Which will probably still be short. Because weekend, or something.

So first up is my no-eating-out-accountability update for the end of October (25th through the 31st). I did grab some fast food here and there, but I used a Visa gift card that I had originally earmarked for something else and then changed my mind, so no money out of my pocket. There is one mysterious transaction I can't account for, from the 29th. Apparently I bought breakfast or a snack or something from the cafeteria for $3.80. Kind of freaked out that I don't even remember doing it. But other than that, I managed to overcome temptations or use gift cards or just snack on brought-from-home items. And I packed lunch! Every day! Except the one that I bought lunch with the Visa gift card! So in all, last week was my most successful week of the month. And now it's November, so excuse me while I go inhale some sushi from Maki Go next door, which I have been craving literally all month.

Mmmm, sushi. *wipes away drool* Now then, on to the next topic. The other "ban" I put myself on was clothing items. Because in September, I blew all of my September AND October clothes budgets on a trip to Discount Fashion Warehouse. I got a great haul, but it took a lot of self-restraint to not buy anything in October. I may have gone through shopping withdrawal. I even managed to keep my Halloween costume pretty cheap, buying close-but-not-quite items that were better deals than the real things. I did need a pair of khakis for the costume, but I was able to score this pair from Old Navy for way cheap, thanks to a $10 off coupon my friend gave me and the remainder of that aforementioned Visa gift card. So, you know, I didn't actually spend MY money on them at all! Great success!

Er...that's really all I got. Have a great weekend, everyone! I think I'll go do some clothes shopping, now that my budget has been restored ;)

I blew my budget three ways to Sunday last month, so this month I'm trying really hard not to eat out at all. To help with this goal and hold myself accountable, I'm blogging each week about how I did.

So last week I did really well, coming in at only $8. This week? Yyyyyyeah, not so much. When I set a "no-eating-out" goal for this month, I completely failed to account for two things: Homecoming Weekend at OU last weekend and visits from my best friend and my sister this weekend. I refuse to let "oh I'm trying not to spend money" get in the way of fun times with friends and family. I was that person for a long time, and I hated it. So I'm not going to do it anymore. I fudged a bit last weekend. (And I'm sure I'll fudge this weekend as well.) And even those things aside, this week wasn't the greatest. Here's my little spending diary for the last seven days:

Friday, October 11

Date night with Matt. He got dinner, I had the movie tickets pre-paid via a Groupon purchased last month. Spending averted, woohoo!

Saturday, October 12, 10:30 am

I cave and buy breakfast on the way down to Athens. Getting Panera en route to OU is kind of a tradition for me; $7.57. Then it's lunch with Anna and her bf at Miller's Chicken, aka THE BEST DAMN FRIED CHICKEN PLACE IN THE WHOLE WORLD; $17.17. Dinner is this great guilty-pleasure Chinese place I love while Anna's at work; $6.75. I also buy drinks, but I don't count booze as "eating out." Cheating, perhaps, but hey, we're all human. And it's Athens, so drinks are insanely cheap anyway.

Sunday, October 13, 12:30 pm

Brunch with Anna at Court Street Diner; accidentally forget my real card in her dorm room and use a Visa gift card I had on hand, so technically free.

Tuesday, October 15, 7:21 am

Forgot to pre-mix my quinoa fruit smoothie last night. Womp womp. Think about eating breakfast and immediately feel sick. Good thing I bought some enormous apples yesterday; here's hoping that works.

(later that morning)

It totally does! Score.

7 pm

Finish running post-work errands and I'm literally week with hunger. Panera--my kryptonite--is in the next plaza over, but I resist and head home to heat up leftovers. Equal parts disappointed and proud.

Wednesday, October 16, 10 am

Woke up exhausted and therefore pretty nauseous. Can't even handle coffee. Feeling kind of bummed today, too. (Maybe it's all this rain?) Decide I deserve a treat: Breakfast sammie and a latte from Starbucks. $6.70, but worth every penny. It's not about spending money to cheer myself up--it's about deciding to treat myself in some way and then not beating myself up or feeling guilty about it.

Thursday, October 17, 10:30 am

No smoothie again, thanks to the blender in the dishwasher. Snag a mini cupcake from the next office over and inhale a granola bar...

11:55 am

Thank god, it's late enough to be considered lunchtime! Still, I didn't buy breakfast. Yay!

Total for the week: $38.19. Ehhh...it's not awesome. But it's still less than the $50/week I usually allot myself for food/beverage/entertainment spending, so I guess it's not a total loss.

I blew my budget three ways to Sunday last month, so this month I'm trying really hard not to eat out at all. To help with this goal and hold myself accountable, I'm blogging each week about how I did.

So the past week wasn't the worst in terms of my spending habits, but it wasn't the best either. I've been using the Notes app on my phone to journal my progress. Here's what I wrote over the last seven days:

Friday, Oct. 4, 12:42 pm

In my rush to get out the door this morning, I didn't pack enough food for lunch. Thought it would be enough, but I was wrong. Bought a small order of wings from the cafeteria--nothing else. $4.50. Realized halfway through that I wasn't that hungry after all. New goal: Wait 20 minutes after eating to buy more food, to give my stomach time to realize whether it's actually hungry.

Sunday, Oct. 6, noonish

Didn't get a chance to eat before running some time-sensitive errands. Wanted Panera for lunch, but settled for a $1.06 bagel (free butter, not cream cheese) and ate lunch for real when I got home.

Tuesday, Oct. 8, 10:30 am

So my biggest foe seems to be breakfast. The thought of eating within the first hour or two of waking up makes me physically nauseous, so I usually skip breakfast in favor of a cup or two of coffee. And of course by this time, I'm starving. This morning I tried Sydney's trick of making a breakfast smoothie, downing it pre-coffee as I packed my lunch and wiped down the kitchen. My stomach still is making the loudest grumbles you've ever heard. I'll give the smoothies a few more days (made a big batch of pre-mix), and maybe see how the Noble Pig's suggestion of adding quinoa works out, then I'll try my backup: packing breakfast.

Wednesday, Oct. 9, 10:24 am

Running errands on my morning break and I'm starving. Pop my head into Starbucks for a breakfast sandwich, but the line is a dozen people long. Take it as a sign and leave. There's a granola bar in my desk.

Same day, 10:30 am

Granola bars make me sad.

Thursday, Oct. 10, 10:25 am

Didn't have time for a smoothie this morning. I'm grumpy, tired, and hungry. Whatever, I'm getting cheese fries. (JK, I just couldn't resist the Mean Girls quote. I got bacon and eggs from the cafeteria--$3.30. They were completely unsatisfying, as I got the leftover bacon crumbles from breakfast service. Part of me feels like I deserve this for cheating. Womp womp.)

Total for the week: $8.85. Not bad. I managed to pack my lunch every day. Considering that the average cost for lunch downtown is anywhere between $8 and $10, I've actually done very well compared to the buy-lunch-two-or-three-times-a-week habit I was in last month.

So I'm sitting at my desk, thinking about how hungry I am and contemplating running downstairs to get a little midmorning breakfast from the cafeteria or the deli next door. A bacon-egg-and-cheese sandwich sounds pretty damn awesome right now. But then I remember that I have a Kind bar in my drawer. And that it will be both free and filling enough to tide me until lunch. So I pull it out and as I type, I'm munching on almonds and Madagascar vanilla-flavored crisp rice. It's nowhere near as satisfying as a hot breakfast sandwich, but it's tasty and it'll do.

Why am I telling you this? For self-motivation. For accountability. I've discovered that when I blog about a goal -- in this case, not spending money on eating out this month -- I'm more likely to stick to it. Because I know people see it. And sometimes, like in Sydney's recent post, I get external support and encouragement as well.

So for this month at least, I'm bringing back Fiscal Fridays as a weekly feature. I'll keep a record of all the times I want to spend money on clothes or food or whatever when I shouldn't, and document how I did. I might fail. In fact, I'm pretty certain I will at least once or twice. But by forcing myself to document it, and then share that documentation with others, I hope to succeed more often than not.

So thanks in advance for reading these posts, if you do, and my apologies if you find them completely dull. I'll try to have other Friday content for you folks as well :)

Ok, I have appx. five seconds to write this post, so without further ado, here's how I spend my $100 clothes budget this month:

1. Ohio University Alumni T-shirt from Uptown Dog in Athens. $10 |exact|

I actually had this shirt before, lost it (or someone took it?) and now, two years later, I am thrilled to have it back in my closet again. So much love.

2. Old Navy t-shirt, purchased as XL so it'd be roomy and adorably oversized. On sale for $8.29

3. H&M LBD with a sexy zipper that goes all the way down. Clearance, $15

4. Old Navy 3/4 length t-shirt. I first saw it on the commercial, then on Kendi, and I knew I had to have it. On sale for $6.65

5. Express spike necklaces in antique gold and silver. On sale, buy one get one for $9.90. Total price for both, $40 |exact|

6. Old Navy pencil skirt. Because I can't get most of my pencil skirts from last year up over my thighs/butt :( On sale for $17.50 |exact|

7. Old Navy long chain necklace. Didn't have a price tag, so the awesome cashier grabbed the cheapest necklace on the rack and rang up this one at that price. $7.95

Total amount spent, including tax: $113.56. Less than $15 over...not too shabby!

Ok, so I'm all about transparency and accountability (working for the government will do that to a person, I guess), so I'm going to own up to something: I blew my March budget to pieces. It was horrible. It was — quite literally — one of the worst months, budget-wise, I've had since graduating college. I'm not quite sure what happened; maybe visiting my sister put me in such a giddy mood that I overspend on everything else. Maybe I was just so bored (or should I say, am so bored) of cold weather that I spend money to make up for the lack of sunshine in my life. Whatever it was, it was terrible.

Remember that reasonable, only-$7-over-and-with-a-return-actually-$30-under clothes budget I posted about two weeks ago? Yeah, screwed that one up royally. I spoke too soon and ended up being about $65 over. And it wasn't like I bought a really great closet staple or a fun statement piece. First, I went with the gift card refund on the dress from eShakti instead of the dress, because the gift card is worth 20% more than the original purchase. Then, I promptly forgot that I didn't opt for cash back, and re-spent that $38 on a cute t-shirt at JCPenney ($10) and some slightly-gauged hoops at Hot Topic. ($13) The ball on my cartilage piercing fell out and I wanted to replace the hoop in my tragus as well, so I figured, $13 for a half-dozen new hoops was a good deal.

Lesson of the day: Seriously, don't buy body jewelry at Hot Topic. It's crap. I ended up having to go to a local piercing/tattoo shop here in Columbus to spend $30 on two quality hoops. At least the balls on these hoops are attached on one end, so I can't loose them again. There is a good chance I will wear these earrings for the next several years without ever taking them out. (If anyone in Columbus is interested, I went to Evolved. The staff was wonderful, the selection was great and they even switched out the piercings free of charge so I wouldn't have to clumsy-finger it at home.

Anyway, clothing wasn't the only category I grossly overspent on. I was also more than $100 over my grocery budget (usually set at $200) and $60 over my eating out/bars/fun stuff budget (also usually $200). All in all, I'm pretty disappointed in myself.

Maybe I'm being too hard on myself because I had a stressful, crap day at work. But part of me worries that if I don't beat myself up at least a little, I'll spend all willy-nilly again this month and the next month and the next...

I guess I should give myself at least some credit. If I overspent that much two years ago, I would have been in a panic. I would have been cramming expenses onto a nearly-maxed out credit card, asking to borrow money, panicking. Now, I'm mostly just annoyed at myself. So I guess that's a plus?

I only have time for a quick post, as Matt and I are in South Carolina visiting my sister and brother-in-law for the weekend, and said bro-in-law is clamoring for dinner. So. I only bought two things with my $100 clothes budget this month, but that's okay because one of them is a pair of SWEET running shoes:

I got them on sale at Kohl's for $69, and they're pretty awesome. Plus, they're cute, so they motivate me to go running to train for my races this summer :) The other item was this dress from eShakti:

I got them on sale at Kohl's for $69, and they're pretty awesome. Plus, they're cute, so they motivate me to go running to train for my races this summer :) The other item was this dress from eShakti:

Unfortunately, I requested an altered sleeve shape for this (cap sleeve instead, for work propriety) and it didn't fit well, so I'll be sending it back. It was only $38 because I had a gift card, so really I was only about $7 over my budget. I'm not sure if I'll exchange the dress for an un-altered one, or just get the money back, but either way I did pretty well on my budget this month, I think. Hooray!

How did you do on your budgets (if you have one) this month?

Unfortunately, I requested an altered sleeve shape for this (cap sleeve instead, for work propriety) and it didn't fit well, so I'll be sending it back. It was only $38 because I had a gift card, so really I was only about $7 over my budget. I'm not sure if I'll exchange the dress for an un-altered one, or just get the money back, but either way I did pretty well on my budget this month, I think. Hooray!

How did you do on your budgets (if you have one) this month?

Ok, so this is too late to even be a Fiscal Fridays post, but I decided to take a break from my note-compiling and story-writing to cobble together my February Budgeting Bloggers post. At first glance, it might look like I was under my $100 budget, but I wound up having to re-appropriate a bit of my February clothing budget to pay for other things. So really, I broke even. Hey, I'll take it.

1. Almay Intense I-Color Bold Nudes Eyeshadow (for hazel eyes) - appx. $6, CVS

2. Sephora 8 HR Mattifying Compact Foundation - $22, Sephora

3. polka dot ties - $7, The Limited (clearance)

4. assorted bracelets - $7, Target (clearance)

5. gold necklace - $15, The Limited (with 40% off coupon)

6. Maybelline Mega Plush Volum Express mascara - appx. $6, Target

7. studded leopard print flats (seen here) - $20, Target ||exact||

So in all, my clothing/makeup purchases came to about $83. Not bad! How did you guys do on your clothing budgets, if you have one? (Also, you can check out more budget-savvy bloggers over at Franziska's link-up!

So I decided to jump on Franziska's Budgeting Bloggers bandwagon, and post monthly recaps of how I spend my clothes "allowance" each month. I love the idea of holding yourself accountable by telling the world how you're doing (if you hadn't guessed, based on my previous Fiscal Friday posts). So from now on, I'll do a little recap on the last Friday of every month.

But Emma, I hear you say, this is the FIRST Friday of February! Stop confusing us! I hear ya. I would've posted this last Friday, but I didn't decide to start linking up to this shebang until two days ago. And I figure, February 1st is really just kind of the same as January 32nd. And that's why I'm reliant on my phone's calendar.

Anyway. Here's the breakdown. I give myself $50 from each paycheck to spend on clothes. So most months, I get $100. (Except some months I get $150. WOOHOO!) January was a unique beast for another reason, however. I got a freelance paycheck. And since I don't factor those into my monthly budget, they're free money to do with as I see fit. Sometimes I save them, sometimes I put them toward debt payments. This one I spent on fun times with Emily and Stephanie, and some much-needed retail therapy. So technically, I'm over my $100 budget, but not really, because I had extra money to play with :)

I provided links where I could, but a lot of this stuff was clearance/not available online. As for the whole blogger movement of providing links to similar items...uhh, sorry. To quote Sweet Brown, ain't nobody got time for that.

1. Snake print heels - $15, Target - Because who doesn't need snakes on their feet? ||exact||

2. Black flats - $25, Target - To replace my old black flats, which died :( ||exact||

3. Black skinnies - $28, Target - Again, replacements. My other skinnies mysteriously shrunk (along with half of my other pants, of course). ||exact||

4. Black knit hat - $5?, Target - Clearance item!

5. Gray textured skirt -$12, Target - More clearance! I tried to show a close-up detail of the pattern on it, but in the collage it just looks kind of weird.

6. Berry cardi - $15, Target - I'm not sure what color to call this. Tag said "berry," but it's kind of like a magenta or fuchsia, maybe?

7. Moto jacket - $25, thrifted - That's right! This find made my day. Ask Kellyn, she saw all the giddy.

8. Polka dot blouse - $4, thrifted - Polka dots might be my new addiction (see also: stripes)

9. Leopard print belt - $6, H&M - To match my shoes! ||exact||

10. Pearl and chain necklace - $11, VeryJane - Very cool site. It does daily/weekly deals like a Groupon or LivingSocial, but for jewelry, accessories, décor items, etc.

11. Knit tights - $17, H&M - I miss wearing skirts. These might be thick enough to keep me warm!

12. Striped shirt - $8, H&M - Yet another replacement. I stained the last one during a very enthusiastic game of Pictionary with dry erase markers.

13. Flower earrings - $7, H&M - I have been looking for these ever since I saw them on my sister at Christmas.

Total: $180. So really, not all that much overbudget, even. A good month, really...I managed to score a loooooong-term "shopping list" item and plug a few other holes, too. Woop woop!

So today is Black Friday. For you lucky few who aren't familiar with the concept, it's a practice in which bargain-hungry Americans decide to wait in line for hours to buy crap at huge discounts. (Canadian friends: Do you all go out and beat each other silly for half off sweaters and $100 off TVs the day after you give thanks for everything you already have?) Having worked a few Black Friday shifts at a major electronics store back in college, I pretty much loathe the concept. But I won't get into how much I'm disgusted by the rampant commercialism and willingness to give up a great holiday in order to wait in line for 12 hours for a sale here.

No, I'm spending my Black Friday watching movies with Matt and basically digesting from the two enormous feasts we had yesterday with our families. But I can't help but starting to think about my holiday shopping; after all, now that Thanksgiving is over, it's completely seasonally appropriate to start tackling my gifts list.

This year, I'm using a new method for buying presents while staying in budget. And it involves a really cool new Pinterest feature: secret boards.

I'd like to take this moment to disclaimer that this post is not sponsored or in any other way endorsed by Pinterst. It's just something cool that I decided to do and thought to share :)

So anyway, I realized I could make a secret board to organize, tag and price my entire gift list. And I'm the only person who can see it; the pins don't appear anywhere on my profile, but I can see them any time I want. So I just shopped online for everyone, pinned everything I thought might work, and tagged the pin with a name and a price. If you're new to the pinning scene, adding a price to a pin actually displays the price over the image, like so:

I'd like to take this moment to disclaimer that this post is not sponsored or in any other way endorsed by Pinterst. It's just something cool that I decided to do and thought to share :)

So anyway, I realized I could make a secret board to organize, tag and price my entire gift list. And I'm the only person who can see it; the pins don't appear anywhere on my profile, but I can see them any time I want. So I just shopped online for everyone, pinned everything I thought might work, and tagged the pin with a name and a price. If you're new to the pinning scene, adding a price to a pin actually displays the price over the image, like so:

Images blacked out so no one guesses what I'm getting them :)

So anyway, as I narrow down my options for each person, I'll have a pretty clear idea of exactly how much I'm spending...and when I'm ready to buy everything, I can just click through the links and have everything delivered to the house. Easiest. Holiday. Shopping. Ever.

Do you have any tricks for not overspending during your holiday shopping?

Images blacked out so no one guesses what I'm getting them :)

So anyway, as I narrow down my options for each person, I'll have a pretty clear idea of exactly how much I'm spending...and when I'm ready to buy everything, I can just click through the links and have everything delivered to the house. Easiest. Holiday. Shopping. Ever.

Do you have any tricks for not overspending during your holiday shopping?

So just in case you missed all my geeking out, Matt got me an iPhone for my birthday. And I'm a complete spaz about it. I download apps like it's my job. And then I realized...there's more to the iPhone than Instagram and Fruit Ninja. The variety of financial apps is simply astounding. So I did some research, tried some out, and decided to do a post on my favorites.

Now, before I get started, I want to point out one major point about my list. It does not include the free Mint.com app. I downloaded it, tried it out and ultimately decided that it's not for me. Don't get me wrong, it's an incredible app that lets you track even the tiniest aspects of your budget. It's fully comprehensive, linking to your bank accounts and automatically categorizing your spending habits as they happen. And that's precisely why I decided I didn't like it. I'm pretty Type-A, and I want to categorize things in my own quirky way. For 99% of you, Mint.com Personal Finance could be an all-inclusive budgeting solution. But for me, here's what I use.

Chase Mobile

This was the very first app I downloaded. I had the Android version on my old phone, and on the iPhone it's pretty much the same. Most banks now have their own apps, so I definitely recommend downloading the app for your bank. From the login screen, you can find locations and access contact info. Once you log in, you can transfer money between accounts, pay bills, view recent transactions...pretty much anything you can do on the chase.com website. Plus, the coolest feature lets you deposit checks by taking a photo of them. This isn't exactly a new feature in the world of mobile banking, but I still geek out a little every time I use it.

Dropbox

This was the very first app I downloaded. I had the Android version on my old phone, and on the iPhone it's pretty much the same. Most banks now have their own apps, so I definitely recommend downloading the app for your bank. From the login screen, you can find locations and access contact info. Once you log in, you can transfer money between accounts, pay bills, view recent transactions...pretty much anything you can do on the chase.com website. Plus, the coolest feature lets you deposit checks by taking a photo of them. This isn't exactly a new feature in the world of mobile banking, but I still geek out a little every time I use it.

Dropbox

Okay, so this isn't actually a financial app per se. But I do my budget in an Excel spreadsheet (more on that here), so this app lets me view my balances on any computer or on my phone. I can't edit it on the phone, but really when I'm on the go, the only thing I need to do is check my balances for certain amounts anyway. But now, I can do that even more easily thanks to...

Spendings

Okay, so this isn't actually a financial app per se. But I do my budget in an Excel spreadsheet (more on that here), so this app lets me view my balances on any computer or on my phone. I can't edit it on the phone, but really when I'm on the go, the only thing I need to do is check my balances for certain amounts anyway. But now, I can do that even more easily thanks to...

Spendings

This is a great little app that helps me track how much I have left in certain budget areas. I have categories set up on a bi-weekly basis (because my paychecks are bi-weekly) for all my petty spending, including groceries and gas. Whenever I make a purchase, I just enter the amount and the name of the store into the app and it displays how much I have left in that budget area. (Mint.com does this for you automatically, but like I said, I prefer to track it myself...I feel like it keeps me more accountable!)

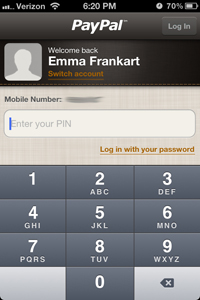

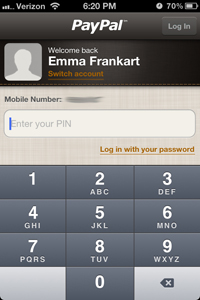

PayPal

This is a great little app that helps me track how much I have left in certain budget areas. I have categories set up on a bi-weekly basis (because my paychecks are bi-weekly) for all my petty spending, including groceries and gas. Whenever I make a purchase, I just enter the amount and the name of the store into the app and it displays how much I have left in that budget area. (Mint.com does this for you automatically, but like I said, I prefer to track it myself...I feel like it keeps me more accountable!)

PayPal

I still freelance for TopTenREVIEWS on occasion, and they pay me via PayPal. I also manage my blog ad payments via PayPal. This app lets me check my balances, request payments from advertisers and transfer money from PayPal to my bank account with just a few clicks.

RetailMeNot Coupons

I still freelance for TopTenREVIEWS on occasion, and they pay me via PayPal. I also manage my blog ad payments via PayPal. This app lets me check my balances, request payments from advertisers and transfer money from PayPal to my bank account with just a few clicks.

RetailMeNot Coupons

Okay, this one doesn't exactly help me track my finances. But it does help save me money with lots of coupons! Most of them can be scanned right from your phone, while others display a coupon code that cashiers can type in. Helpful? Money-saving? You know it.

Well, there you go! My current top financial/budgeting/money-related apps. Do you have any favorites that I missed?

Okay, this one doesn't exactly help me track my finances. But it does help save me money with lots of coupons! Most of them can be scanned right from your phone, while others display a coupon code that cashiers can type in. Helpful? Money-saving? You know it.

Well, there you go! My current top financial/budgeting/money-related apps. Do you have any favorites that I missed?

I have to make this quick, because as usual, I'm running behind this morning. But I did want to talk about my new budget and the official end of the Financial Diet! (Cue the loud cheering, etc.)

Now that I'm working with an income that doesn't necessitate my living paycheck-to-paycheck, I've been able to rework my monthly budget. Of course, it might be a few months before this exact budget goes into effect, since I have a lot of wedding-, bridesmaid- and car-related expenses to account for this summer. But I'm still using the figures below as the bare bones of my summer budget, and honestly, I really look forward to this fall, when I'll be able to implement it fully.

First, a comparison to my old "budget." The first thing I did when my paycheck came in was pay all my bills that were due before my next paycheck. Then, I bought groceries and put gas in my car. Next, I took care of any other expenses—random things that tended to pop up. Finally, I took $60 and set it aside as "spending" money. If there was any money left over, I made sure to save it because I usually needed it to help cover my next round of bills. Now, I have a set "spend this much on x" breakdown. For modesty's sake, I'm using percentages here instead of actual figures.

The Budget Breakdown

Before I even see my money, my retirement savings (about 10%) and health insurance premiums (about 2%) are deducted from my paycheck. The rest is up to me to disperse. Bills (rent, cell phone, utilities, cable, gym payment, insurance) take up about 29%. Groceries are another 7.5%. My debt, including car payments, credit cards and loan payments to my dad equal about 26%. That number won't change until all my debt is paid off, per Dave Ramsay's debt snowball. Basically, when one debt is completely paid, I'll use the money I was spending on it and put it toward another debt. Right now, my savings are minimal because I'm focusing on debt reduction; I'm saving just 2% of my paycheck right now, as I already have a small emergency fund in place. And my spending money, which covers clothes, entertainment, dining out, house décor and everything else, is a comparatively indulgent 15%.

For those of you keeping track, that adds up to about 95% of my monthly income. The extra 5% is wiggle room for small, unaccounted-for things, like oil changes, minor car repairs, doctor's copays, etc.

So there you have it! A brief breakdown of my ideal budget, once I get this Summer of Crazy out of the way. I'm pretty excited about it. And when I have all my debt paid off, in about a year and a half by my estimations, I'll have to rework my budget again...this time, focusing on building up a REAL emergency fund and saving up for grown-up things like a wedding and a down payment on a house. Woot!

If you're looking for more budget inspiration, check out Whitney's post over on Between the Lines. She has a really awesome, simple system set up with her hubby!

Well, no one wrote in with questions about taxes. And since I don't really consider myself an "expert," I'm not going to sit here and walk you through the huge process of filing them. I will say this: if you just have simple return (regular W2, even if it's more than one of them), use TurboTax's online filing system. It's super easy, and it's free. But don't use them for state taxes; it costs extra and if you do it online through your state's website, that's free as well. It's a little more complicated, but I was still able to do it last year without any problems. And if I can do it, well, anyone can :)Since I didn't have anything else else prepared for today, I'm just gonna throw you a random link. Apartment Therapy posted this pretty cool piece a while back about 100% realistic budgeting. Honestly, I've covered a lot of this stuff before, but I'm so wordy, and this version is so concise, I thought it'd be fun to share.

So when I started this budgeting theme for September's Fiscal Fridays posts, I didn't realize there were five Fridays in the month. And I really already covered all the main topics I wanted to touch on. Oops.

Image via Wikimedia CommonsSo I decided to do something a little different this week. Instead of me blah-blah-blah-ing about budgeting stuff, I'm turning things over to you for the rest of the month. Today through next Wednesday or Thursday, I'll be taking your questions and comments on budgeting. Curious about something I covered earlier? Wondering about a topic I didn't discuss at all? Have your own tips or ideas that you'd like to share? Email them all to me at verbal{dot}melange{at}gmail{dot}com. Next Friday, I'll answer questions, share tips and generally make the post into more of an open forum.So what are you waiting for? Drop me a line :)

I'll be honest...today's post is less of a "how-to" and more of a persuasive argument. I'm talking, of course, about saving money. I can't really tell you how to save more, because frankly, I struggle with that myself. Hell, I had to get a job waitressing so I could have extra money to put into savings. And maybe that's what you need to do, too. Or maybe you need to stop going out to eat, or start shopping exclusively at thrift stores (another thing I've decided to do, but that's a post for another day). Whatever your method, the end result should be the same: to save more for your emergency fund.

(image via Wikimedia Commons)So how much should you be saving? Well that, my friends, is the million-dollar question. Conventional wisdom says that you should have enough money in a savings account to cover three months' worth of bills, should you get laid off, become hospitalized or encounter a similarly horrible situation. And that's a great goal to set. But you won't get that much money saved up overnight. In fact, depending on your situation, it could take years to save that much extra dough.This is where your short-term emergency fund comes in. Ideally, you should be setting money aside into two separate savings funds: your long-term emergency "three-months'-bills fund, and your short-term emergency my-car-just-broke-down fund. The amount your short-term fund should have will, again, vary with your situation. But if you're unmarried with no kids, I suggest having around $1,000 to $3,000 in that fund at all times. I myself am shooting for $2,000 or so.This short-term fund is exclusively for those random little annoying things that pop up and completely destroy your budget: a car repair, an unexpected doctor or vet bill, etc. This fund is NOT for "oh my God my favorite store is having a 1/2 off everything sale let's go shopping yeahhhhh!" Nor is this fund for things like vacation, weddings, or other events that you plan ahead for. You should have a third savings fund for those kind of things, since you can plan them out ahead of time. Don't have the extra money to set aside for that vacation? Guess you're staying home this year.To summarize, you should have at least two (if not more) savings funds: one with enough money to cover three months' bills for catastrophic emergencies, one with a grand or two for minor emergencies, and any other smaller funds to cover planned expenses like a vacation (or, if you want, a major shopping spree). I suggest keeping the major emergency money and the minor emergency money in two separate savings accounts (plus, you sometimes get a cash bonus when you open a savings account, so there's a bonus). The vacation-wedding-shopping-spree-new-computer fund money could stay in your minor emergency savings account, or you could even keep it in your sock drawer.I know what you're thinking. "Emma, I'm 25 years old, I make crap money at my job. I'll never be able to do this." Believe me when I say that I know how you feel. That's why I'm waitressing. I knew I'd never save the money without another job, and I knew that it was time to grow the heck up and start planning for things like an adult. You can't depend on your parents to bail you out of financial emergencies forever. (Well, maybe you can, but I can't, so here we are.)Is saving money easy? No. Is it fun? Hecks to the no. But is it rewarding? You bet. I can't wait until the day when I know I have enough finances to cover whatever life may throw at me...that's a kind of security and comfort that money simply cannot buy.